Fast Approvals Don't Have to Mean Less Control

For finance departments, few things are more frustrating than approval delays especially when the stakes involve disbursements, reimbursements, or budget releases. But streamlining approvals doesn’t mean relaxing controls.

The truth is: digital tools like e-signatures help speed up approvals and strengthen governance at the same time.

Traditional Approvals: Where the Slowdowns Happen

Manual financial approvals often involve long email chains, printed documents, unclear routing, and tracking spreadsheets that are prone to error. These bottlenecks create delays that ripple across teams, especially when:

- Documents are sent to the wrong approver

- There's no visibility on approval status

- Physical signatories are unavailable

- No audit trail exists for compliance checks

How E-Signatures Change the Game

Modern e-signature platforms introduce structure, visibility, and speed into finance workflows. Here’s how they help:

✅ Real-Time Routing & Notifications

Documents move automatically from one approver to the next. Built-in alerts notify signers when their action is needed no follow-up emails required.

✅ Role-Based Access Controls

Finance teams can control who can draft, edit, sign, or view documents. This preserves internal controls and aligns with audit protocols.

✅ Immutable Audit Trails

Every action opening, editing, signing, rejecting is timestamped and logged. This ensures accountability and audit-readiness for internal or external review.

✅ Identity Verification

Multi-factor authentication and eKYC options (e.g., ID + selfie) confirm who’s signing. This is especially important for high-value transactions or inter-department approvals.

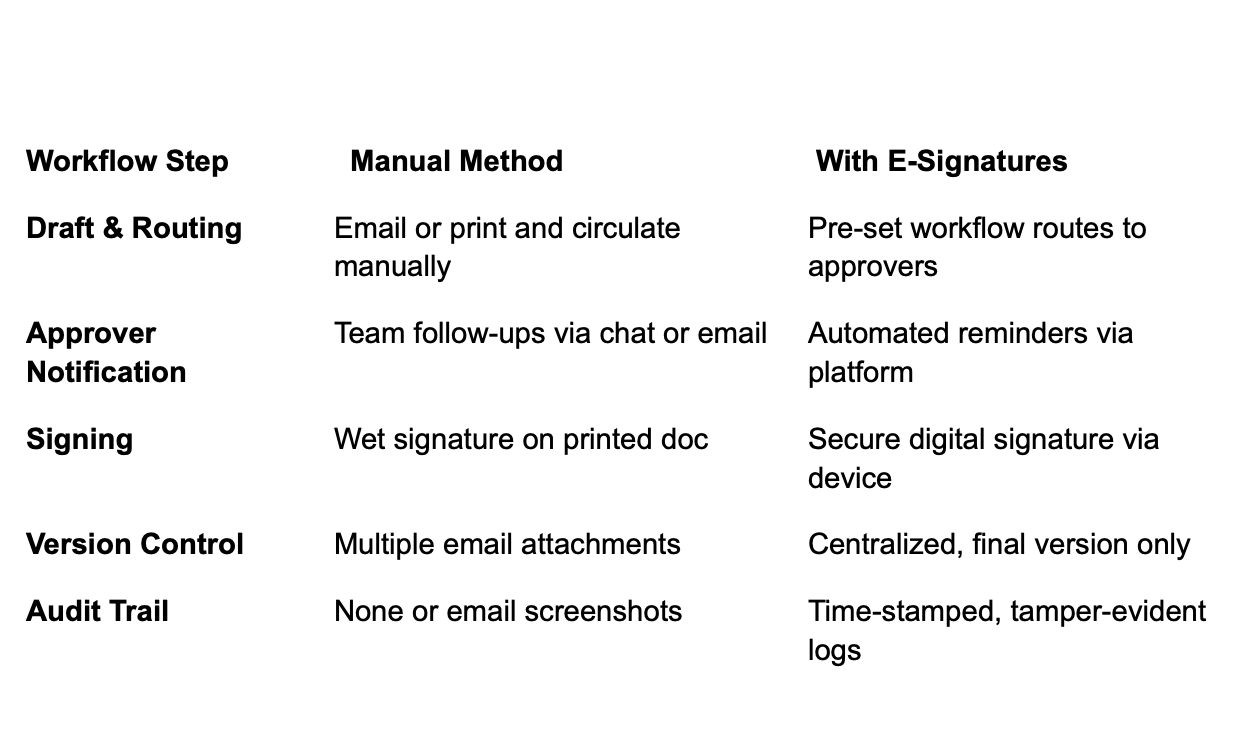

Manual vs Digital: A Workflow Comparison

Built for Philippine Compliance

Under Republic Act No. 8792 – The E-Commerce Act, e-signatures are legally recognized in the Philippines as long as they can prove identity, intent, document integrity, and auditability.

Government offices and state auditors such as the Commission on Audit (COA) have increasingly encouraged the use of secure, verifiable digital workflows in line with digital governance goals. This includes moving toward electronic submissions, approvals, and audit processes provided that digital tools used can ensure data integrity, traceability, and proper authorization controls.

This means finance teams, even in regulated environments, can adopt e-signatures as long as they meet the right standards.

Fast doesn’t have to mean risky.

With the right e-signature platform, finance teams can automate routine approvals, eliminate manual slowdowns, and still maintain full visibility and control. It’s a smarter way to handle high-volume financial documents and it’s already being adopted by compliance-conscious organizations across the Philippines.

%20(1).png)

.png)